- Insurance Services

- Auto, Home & Personal Insurance

- Business Insurance

- Business Interruption Insurance

- Business Owners Package Insurance

- Commercial Auto Insurance

- Commercial Property Insurance

- Commercial Umbrella Insurance

- General Liability Insurance

- Hotel & Motel Hospitality Insurance

- Professional Liability (E&O) Insurance

- Surety Bonds

- Workers' Compensation Insurance

- - View All Business

- Life Insurance

- Group Benefits

- About

- Policy Service

- Contact

Traditional 401(k) Vs. Roth 401(k)

Posted: March 28, 2020

The Roth 401(k) was introduced in 2006 and is becoming increasingly more common. The bigger the company, the more likely it is that employees will have the option of contributing to a Roth 401(k). Although the traditional 401(k) and the Roth 401(k) share some similarities, there are also major differences between the two. What Is A Roth 401(k)? A Roth 401(k) is a type of...

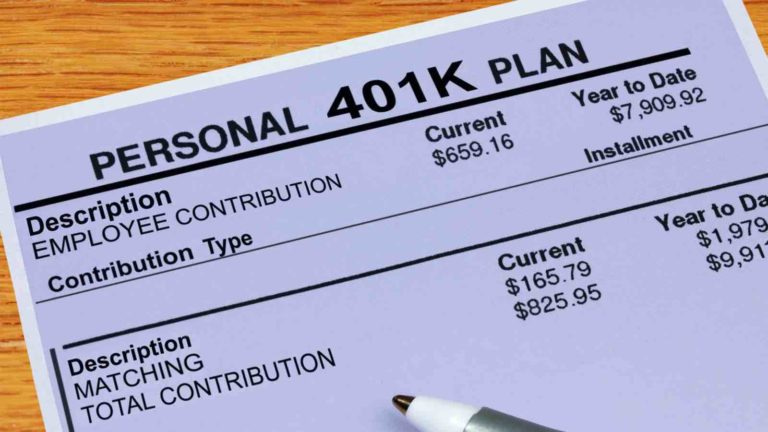

What Happens If I Stop Adding To My 401(k)?

Posted: February 28, 2020

Contributions to a 401(k) can stop for a variety of reasons. You may have been laid off or fired or left your job voluntarily. You could also choose to stop your 401(k) contributions while still employed with the company, with no penalty for doing so. What happens to your 401(k) after you stop adding to it may be largely up to you, depending on the...

Should I Offer My Employees Health Insurance Or 401(k) First?

Posted: January 13, 2020

It is an employees’ market today, which makes it a challenge to find the best talent. Once you get them on board, the next challenge is retention. Offering a great employee benefits package is one of the best ways to keep your best employees. Although there is some cost to the company, providing a range of employee benefits helps keep your business stable. If you...

What Happens If I Stop Adding To My 401(k)?

Posted: December 28, 2019

If you have a 401(k) account through your employer, it is never a good idea to stop contributing to it, even temporarily, if you can possibly avoid it. If you are experiencing a financial crisis of some sort, the solution is not to stop adding to your 401(k). The following are some important reasons to continue contributing to your 401(k), even in times of financial...

What Does Being “Vested” In Your 401(k) Mean?

Posted: November 28, 2019

As defined by the IRS, vesting in a retirement plan means ownership. Each employee vests a certain percentage of their account in the 401(k) plan every year. An employee who becomes 100% vested in his or her 401(k) account balance owns 100% of the balance. When this occurs, the employer cannot take it back (forfeit) for any reason. Amounts that are not vested in a...